News

You will Receive Less if a Technical Change to Determine Social Security Benefits is Adopted

This article (http://www.dailykos.com/story/2013/02/18/1188129/-You-will-Receive-Less-if-a-Technical-Change-to-Determine-Social-Security-Benefits-is-Adopted?showAll=yes) was first published at the Daily Kos on February, 18, 2013.

By GREGORY N. HEIRES

As deficit talks resume in the coming months, Social Security will once again likely be targeted for cuts.

One of the more popular proposals among Washington insiders is to change how inflation is calculated when benefits are set each year.

Now the White House has given new life to the proposal, which earlier floated by the administration—and supported by House Speaker Nancy Palosi–during the debate over the tax deal at the end of 2012.

Proponents like to depict the adjustment as a technical tweaking that provides for a more accurate measure of inflation. But, in reality, the change is about cutting Social Security.

The new inflation measure, known as the “chained” Consumer Price Index, would reduce the annual cost-of-living adjustment by 0.3 percent.

A small amount?

Well, no, if you rely on Social Security for most of your retirement monthly income, which is the case with most retirees.

The reduction would slash the Social Security benefit by 3 percent over 10 years ($135 billion)–and 6 percent over 20 years. That’s a substantial sum when you’re living on a fixed income, so this change would be a big hit on the poor. Average 65-year-olds would get $650 a year less in benefits when they turn 75 and see a $1,000 a year cut when they turn 85, according to Sen. Bernie Sanders (I-VT.).

How does this change work?

Currently, the adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, which is calculated by using price changes in a number of consumer goods.

The “chained” CPI is determined by tracking price changes according to how consumers switch their preferences and expenditures by deciding to spend more on, say, chicken when the price of meat goes up.

But if the supporters of the chained CPI really cared about improving the accuracy of calculating inflation—and not finding a spurious justification for cutting Social Security—they would be talking about using another U.S. Bureau of Labor Statistic index based on the actual spending of seniors. But guess what? That index shows that the price increases of the products seniors purchase fall below the standard measure of inflation.

The chained CPI came up at a White House news conference on Feb. 11, and Press Secretary Jay Carney indicated that Obama would be sympathetic about including the method for recalculating the Social Security benefit within a comprehensive agreement to reduce the $4 trillion deficit that the administration and U.S. Congress will soon consider. This dashes hopes of opponents who had hoped the proposal died last year.

Asked by a reporter if Obama would consider reducing the annual cost-of-living increase for recipients, Carney said, “Again, as part of a big deal, part of a comprehensive package that reduces our deficit and achieves that $4 trillion goal that was set out by so many people in and outside of government a number of years ago, he would consider the hard choice that includes the so-called chained CPI — in fact he put that on the table in his proposal — but not in a cherry-picked or piecemeal way.”

The chained CPI controversy with all its technicalities is a debate that policy wonks love to engage in and doesn’t enter the radar screen of most of us. But if implemented by the U.S. Congress and the Obama administration, the change would drive down our living standards—and the middle class and the poor will be hurt the most.

The adoption of the chained CPI would also be another blow to retirees and baby-boomers approaching retirement.

Already, middle-class retirees are squeezed because of low interest rates, which have significantly reduced earnings from their savings. Workers nearing retirement—who have already been walloped by the 2008 financial debacle and now realize that their 401(k) plans are going to fall short—are in line to take another dagger.

The chained CPI would be a new factor—added to the end of traditional pensions, failure of the 401(k)s as reliable retirement savings plans, and stagnating and falling wages–forcing workers to remain in the labor force until they drop. Will this never end?

The Social Security crisis is a phony crisis. The system will remain solvent until 2033, according to the trustees’ estimate.

The projected deficit of Social Security would be largely wiped out if only Congress would lift the payroll cap—currently $113,700—and require the wealthy to pay more.

Most workers earn less than the cap, so they are being taxed on their full income. Why not ask the wealthy to assume that same burden instead of adopting the chained CPI, which will be yet another blow to the middle class and the poor?

www.thenewcrossroads.com Posted February 23, 2003.

By GREGORY N. HEIRES

Shortly after President Barack Obama called for raising the minimum wage in his State of the Union Address, members of the Party of No lined up to denounce his proposal.

Republican leaders exposed their class interest as they declared that an increase in the minimum wage—whose real value is significantly below what it was a half century ago—would be bad for business, the economy and even workers. Their party line was also filled with mistruths, distortions and callousness.

In effect, these naysayers are declaring that the minimum-wage workers and others who make up the working poor—around 50 million people—don’t deserve to have a decent standard of living. Maybe that’s only to be expected, considering that the Republican Party’s 2012 presidential candidate, Mitt Romney, wrote off 47 million voters, “the takers,” whom he characterized as social leeches dependent on government generosity outside the GOP voting bloc.

“I don’t think a minimum wage law works,” said Sen. Marco Rubio (R-Fla.).

“I want people to make a lot more than $9,” Rubio said. “Nine dollars is not enough. The problem is that you can’t do that by mandating it in the minimum wage laws. Minimum wage laws have never worked in terms of helping the middle class attain more prosperity.”

U.S. House Speaker John Boehner (R-Ohio), appearing at a news conference with Senate Majority Leader Mitch McConnell (R-Ky.), said increasing the minimum wage would actually hurt the working poor. “When you raise the price of employment, guess what happens? You get less of it,” he said.

“A lot of people who are being paid the minimum wage are being paid that because they come to the workforce with no skills,” Boehner said. “And this makes it harder for them to acquire the skills they need in order to climb that ladder successfully.”

Sen. McConnell launched into an ideological rather than a substantive attack of the proposal.

He described Obama’s address as “pedestrian, liberal boilerplate.” Ignoring the poor’s need for an immediate improvement in their living standard, McConnell said that Obama “spoke of workers’ minimum wages, instead of their maximum potential.”

Rubio’s comments reflected an ideologically driven view that we all will prosper if we allow the free market to operate on its own. But his position falls flat on its face once reality stares you in the face.

As the federal government has allowed the real value of the minimum wage to fall over decades, the invisible hand of the market has clearly failed to boost the pay of workers.

Boehner apparently believes that the minimum wage is bad because it discourages workers from building up their skills. Actually, what’s occurred in the last three decades is that business practices and poor public policy—downsizing, privatization, trade policies that have encouraged the export of U.S. jobs, cutbacks in the public sector, the attack on private-sector unions, technological unemployment, the erosion of the minimum wage and globalization—have combined to eliminate millions of good jobs in the United States. Today, the prospects for U.S. workers are poor because most future opportunities are in low-paying jobs in the social-service sector.

As the debate over the minimum wage unfolds, we should expect conservatives to argue that an increase will hurt small businesses, kill jobs and only helps teenagers.

But these conservative arguments aren’t very persuasive and are a bit misleading:

•Studies about the impact of the minimum on employment aren’t conclusive. But by and large they show that modest increases in the minimum wage haven’t resulted in insignificant job losses. •Two-thirds of low-wage earners work for big companies, which are better able than small businesses to absorb modest pay increases.

•Though teen-agers are commonly identified as minimum-wage workers, a recent Economic Policy Institute report found that nearly 90 percent of workers paid the minimum wage are 20 years old or older. More than a third are married and over 25 percent are parents, according to the report.

No, raising the minimum wage doesn’t amount to unsound public policy.

Raising the minimum wage would be good for economy. It would be a great help to the working poor. Obama’s proposal reflects government’s appropriate role of correcting the injustices of the free-market economy.

So, what are some of the most compelling arguments for raising the minimum wage?

First, economists cite the drop in value of the minimum wage as one of the major factors explaining the declining and stagnating incomes that have walloped the poor and middle class over the past 30 years. Raising the minimum raise would significantly increase the household income of the working poor and attack one of the principal factors driving the erosion of income of nearly everyone by the 1 percent.

Second, the decline of the minimum wage has hurt the standard of living of millions of Americans and immigrants by forcing them to take on second and even third jobs to get by.

Third, the lowering of the minimum wage has hurt the economy by curtailing the purchasing power of the working poor. Compared to higher-income groups, the working poor spend a greater percentage of their increases in their disposable income.

Fourth, raising the minimum wage is a matter of economic fairness. Low-wage workers have especially come out short as economic inequality has risen in recent decades.

The Republican arguments against the minimum wage are particularly offensive given that Obama’s proposal is very modest—even inadequate, according to liberal and leftist critics.

Only 5.2 percent of hourly workers, or 3.8 million workers, are paid minimum wage or less. While the percentage of the work force paid the minimum wage is not that high, the minimum wage provides a benchmark for setting the pay rates of millions of low-wage workers.

The last increase in the minimum wage occurred in 2009. The minimum wage would now be $21.72 an hour if it had increased at the same rate as productivity, according to according to a 2012 study of the Center for Economic and Policy Research.

The CEPR study also found that the minimum wage would be $10.52 an hour if it had kept up with inflation since its real value peaked in 1968. Obama’s proposal would link increases in the federal minimum wage to the rate of inflation.

But apart from the technical arguments in favor of raising the minimum wage, the government should boost it from $7.25 to $9 an hour simply because that’s the right thing to do. As Obama said in his State of the Union Address: “Today, a full-time worker making the minimum wage earns $14,500 a year. Even with the tax relief we’ve put in place, a family with two kids that earns the minimum wage still lives below the poverty line. That’s wrong.”

Why doesn’t the Party of No just have a heart and agree to help out the working poor?

www.thenewcrossroads Posted on February 21, 2013

As the Global Elite Enjoy their Champagne and Caviar, Inequality Worsens

By GREGORY N. HEIRES

As the global elite met last week at the annual Davos economic summit, an estimated 200,000 people around the world died during the five-day conference because of poverty-related—and avoidable–afflictions.

The persistence of poverty and rising inequality are stark reminders of how neo-liberal policies promoted by many of the politicians and business leaders at Davos have left behind billions of people as a tiny elite benefits from those policies.

Deregulation, privatization of public assets, tax cuts, austerity, downsizing of government services, the gutting of labor protections and the attack on unions have allowed a small group to accumulate vast sums while the vast majority of the globe’s people cope with stagnating and falling incomes.

But a little redistribution and progressive economic policies could go a long way toward addressing poverty and inequality.

The richest 100 billionaires in the world are worth $1.9 trillion—slightly less than the GDP of the United Kingdom. In 2012, their net income was $240 billion, which a report by the London-based international group Oxfam says “would be enough to eliminate extreme global poverty four times over.” The study was released Jan. 21, two days before the opening of the World Economic Forum in Davos, Switzerland.

“Concentration of resources in the hands of the top 1 percent depresses economic activity and makes life harder for everyone else–particularly those at the bottom of the economic ladder,” said Jeremy Hobbs, Oxfam’s executive director.

“We can no longer pretend that the creation of wealth for a few will inevitably benefit the many–too often the reverse is true,” he said. “In a world where even basic resources such as land and water are increasingly scarce, we cannot afford to concentrate assets in the hands of a few and leave the many to struggle over what’s left.”

Oxfam reports that extreme wealth and extreme inequality are worsening dramatically.

The top 1 percent have enjoyed a growth of income of 60 percent during the past 20 years, according to the Oxfam report, “The Cost of Inequality: How Wealth and Income Extremes Hurt Us All.” Meanwhile, wages in many countries have barely risen in real terms for many years, with most of the gains going to capital, the report says. As inequality has risen, social mobility has fallen rapidly in many countries, according to the report.

In many countries, economic inequality has skyrocketed over the past three decades:

• The share of income of the top 1 percent in the United States has doubled since 1980, increasing from 10 percent to 20 percent. The income share of the top 0.01 percent has quadrupled, which is unprecedented.

• In China, the top 10 percent take home nearly 60% of the income.

• Inequality has increased in many developing countries.

The top 1 percent—60 million people, including 1,200 billionaires–continued to increase their share of income, even after the financial crisis hit in 2008. The luxury goods market has registered double-digit growth every year since then. “Whether it is a sports car or a super-yacht, caviar or champagne, there has never been a bigger demand for the most expensive luxuries,” Oxfam says.

The Oxfam report comes a month after an International Monetary Fund report highlighted global inequality. That report, which studied advanced and developing economies from 1990 to 2005, found that inequality increased in:

•15 of 22 advanced economies and in 20 of 22 emerging market economies in Europe,

•11 of 20 countries in Latin America and the Caribbean (though it subsequently improved in most of them),

• 13 of 15 countries in Asia and the Pacific, and

• 9 of the 12 countries in the Middle East and North Africa.

In Sub-Saharan Africa, inequality increased in 10 of 26 countries. Inequality did, however, go down across the region.

Why Inequality Matters

Conservatives typically argue that inequality doesn’t matter as long as most of us enjoy a decent standard of living. But while that argument may seem to hold some truth in developed countries, it certainly cannot be made in the case of the developing world, where billions live in abject poverty despite economic progress. In fact, the Oxfam, economist Joseph Stiglitz and others make a strong case that inequality undermines the economy–and democracy.

The concentration of wealth and capital in a few hands depresses demand by limiting the spending power of the vast majority of the population. Years ago, a Citigroup report made that point by noting that U.S. corporations are increasingly directing sales to the elite in foreign markets as the purchasing power of the middle class declines in the United States.

If income were spread more equally, demand would be higher, stimulating greater economic growth.

In a recent article in the Guardian, George Monbiot noted that the toleration of inequality, viewed as an incentive for economic innovation, is a benchmark of neo-liberal ideology. And that toleration has proved disastrous.

Monbiot wrote: “The recent jump in unemployment in most developed countries – worse than in any previous recession of the past three decades – was preceded by the lowest level of wages as a share of GDP since the second world war. Bang goes the theory. It failed for the same obvious reason: low wages suppress demand, which suppresses employment.”

The concentration of economic power also has a corrupting influence on politics. The ruling conservative party in the United Kingdom, for instance, receives more than half of its donations from the financial services sector.

Around the world, the financial industry has spent billions lobbying governments to adopt ruinous economic policies, according to Monbiot. “Capture of politics by elites is also very prevalent in developing countries, leading to policies that benefit the richest few and not the poor majority, even in democracies,” the Oxfam report says.

A Global New Deal

What should be done to confront inequality and its corrosive impact on our society?

There are some positive signs. The United States has adopted tax changes that increase what the wealthy pay. And earlier this month, the European Union gave 11 nations the go-ahead to adopt transaction taxes in the financial sector.

Oxfam calls for “a global new deal.”

To begin with, the group proposes the closing of tax havens, which hold as much as $32 trillion, or a third, of all global wealth. That could bring in as much as $189 billion in additional revenue. Other recommendations include:

• reversing the trend toward regressive taxation;

• adopting a global minimum corporation tax rate;

• boosting wages, and

• increasing investment in free public services and the safety net.

“From tax havens to weak employment laws, the richest benefit from a global economic system which is rigged in their favor,” Hobbs said. “It is time our leaders reformed the system so that it works in the interests of the whole of humanity rather than a global elite.”

www.thenewscrossroads. Posted January 29, 2013

By GREGORY N. HEIRES

Conservatives are using the looming showdown over the debt ceiling and deficit as an opportunity to gut Social Security.

But progressives are fighting back by arguing that Americans’ most popular program technically doesn’t contribute to the federal debt or deficit and is securely funded for decades.

“Well, we’ve got to make the president and Republicans and any Democrats that want to cut Social Security an offer they can`t refuse, and that is tens of millions of people have got to make it very clear to Congress — Social Security has nothing to do with the deficit,” Sen. Bernie Sanders (I-Vt.) said Jan. 4 in an interview with MSNBC’s Ed Schultz.

Sanders’ comment reflected the position of some Democrats during the fiscal cliff negotiations late last year when they feared Social Security cuts would be a part of the deal to ensure that scheduled tax cuts and deep budget reductions didn’t go into effect.

“Social Security does not add one penny to the deficit,” Sen. Dick Durbin (D-Ill.) said in an appearance on ABC’S This Week on Nov. 25. “Not a penny. It’s a separate funded operation, and we can do things that I believe we should now, smaller things, played out over the long term that gives it solvency.”

“Over 77 years and now through 13 recessions, Social Security has not added one penny to our deficit or our debt,” Rep. Xavier Becerra (D-CA) said during a fall meeting of the House Ways and Means Social Security subcommittee.

As it ended up, the entitlement programs were spared the ax in the fiscal cliff deal. But deficit hawks are hoping that Social Security will be part of a grand bargain on the federal debt and deficit in the coming months that will be linked to the discussion over the debt ceiling. Durbin proposes that Social Security be removed from these negotiations and instead be assigned to a commission.

Recently, defenders of Social Security have enjoyed backing their position by looking back a few decades to cite the Republicans’ favorite president of modern times, Ronald Reagan–surely much to the horror of many conservative ideologues.

In 1984, Reagan said, “Social Security, let’s lay it to rest once in for all…Social Security has nothing to do with the deficit. Social Security is totally funded by the payroll tax levied on employer and employee. If you reduce the outgo of Social Security, that money would not go into the general fund to reduce the deficit. It would go into the Social Security trust fund. So Social Security has nothing to do with balancing the budget or erasing or lowering the deficit.”

Social Security is a pay-as-you-go program that relies on its own funding stream—not federal income taxes—from the payroll tax. It has its own trust fund, which is separate from the government’s budget for discretionary and military spending. The U.S. Congress, however, borrows from the Social Security trust fund to pay for government programs.

As a pay-as-you go-program, the Social Security system is not allowed to borrow to pay out benefits. Making that point, Dean Baker, co-director of the Center for Budget and Policy Priorities, explains that, “Social Security is prohibited from spending any money beyond what it has in its trust fund. This means that it cannot lawfully contribute to the federal budget deficit, since every penny that it pays out must have come from taxes raised through the program or the interest garnered from the bonds held by the trust fund.”

What is actually going on here is that conservative groups like corporate-funded Fix the Debt are using deficit hysteria as a bogus justification for reducing Social Security benefits and undermining the program, which right-wingers have hated ever since its was created in 1935. Groups like the libertarian Reason Foundation for decades have described Social Security as a Ponzi scheme as they call for privatization. As privatization effort of President George W. Bush failed, the fallback plan of conservatives seems to be to try to chip away at the program.

Yet for all the alarm over Social Security and its supposed contribution to the federal debt and funding problems, the program is on solid ground for the foreseeable future.

Social Security will become exhausted—unable to pay fully for benefits through the payroll tax–in 2033, according to the 2012 report of the Social Security trustees. But even without any tinkering, the program will still be able to cover 75 percent of its benefits if the current payroll tax remains the same.

Economic projections beyond five years are notoriously uncertain. So the trustees’ projections could prove to be wrong if, say, the U.S. economy (in an admittedly unlikely scenario) enters a long period of high growth, which would boost the funding from the payroll tax. The projected shortfall could be addressed substantially by raising the income cap—$113,700 in 2013—on the payroll tax. In any event, claims of Social Security’s pending doom and contribution to the deficit and debt go against the facts.

“Social Security is not part of the problem. That’s one of the myths the Republicans have tried to create,” Senate Majority Leader Harry Reid (D-Nev.) said.

www.thenewcrossroads.com Posted Jan. 16, 2013

By GREGORY N. HEIRES

As Washington politicians are on the verge of pushing the government off the fiscal cliff and thereby triggering huge spending cuts in social programs, the number of impoverished and homeless people is on the rise.

The plight of the poor illustrates how the debate in Washington over how to avert automatic spending cuts and tax increases at the beginning of 2013 isn’t an abstraction.

The failure of U.S. House Speaker John A. Boehner to convince the Republican caucus to approve his alternative to President Barack Obama’s deficit-reduction proposal shows how the party’s reactionary, anti-tax Tea Party faction holds the country’s nearly 50 million poor in contempt and would love, through inaction, to whittle away at the welfare state.

On Thursday, the U.S. Conference of Mayors released its annual report on hunger and homelessness, which found requests for emergency food assistance increased in 21 of the 25 cities (84 percent) it surveyed in 2012. Homelessness increased in more than half of the cities. The surveyed cities included Boston, Chicago, Cleveland, Dallas, Los Angeles, Salt Lake City and Nashville.

With so many people in need, now is the time to be talking about increasing government assistance—especially help for job creation–rather than chopping spending.Yet as the House debates a farm bill, Republicans are looking to cut $16 billion in food stamps.

The president of the Conference of Mayors, Philadelphia Mayor Michael Nutter, on Thursday called for a “fair and balanced budget” that would help combat poverty through investment in infrastructure and spending on other social programs.

“In Philadelphia, I see people who are hungry and in need of shelter on a daily basis,” Nutter said, “and explaining to them that Congress is cutting funding for the help they need is not acceptable. What they need are jobs so they can support their families, and Congress can help to create those jobs if it passes a fair and balanced budget with investments in infrastructure, innovation, and real people.”

If the White House and U.S. Congress fail to reach a deal and the automatic spending cuts go into effect, the country’s municipalities will be hit with a reduction in assistance for services at a time in which they already are unable to provide adequate help to the poor. Consider:

• Because of increased demand for assistance, emergency kitchens and food pantries in nearly all of the surveyed cities were forced to reduce the quantity of food provided to visitors;

• Ninety percent of the cities reported turning away people because of a lack of resources;

• Sixty percent of cities experienced a rise in homelessness, with an average increase of 7 percent, in 2012, and

• Sixty-four percent of the cities indicated that they had to turn away homeless families because of a lack of beds.

Among those seeking food assistance, 51 percent were families and 37 percent were employed, according the survey. Nearly one in six was elderly, and 8.5 percent were homeless.

Greg Fischer, the mayor of Louisville, Ky., who chairs the conference’s committee on metro economies, said, “This report is a stark reminder of the long-lasting impact the recession has had on many of our citizens. Families, who once lived in middle class homes, now find themselves without a roof over their heads, needing multiple social services for the first time in their lives.”

The Conference of Mayors report illustrates the fragility of the recovery from the 2007-2009 recession. Rising unemployment led to more poverty and caused the demand for food stamps to increase dramatically.

Though unemployment has fallen from a peak of 10 percent in the recession to 7.7 percent, the poverty rate is stuck at 15 percent and 47.7 million people rely on food stamps, a record.

www.thenewcrossroads.com Posted December 22, 2012

By GREGORY N.HEIRES

Federal hearings on the relicensing of the Indian Point nuclear power plant have renewed focus on the dangers associated with the facility, which is about 35 miles north of Manhattan.

Situated in a 50-mile region with about 20 million inhabitants, Indian Point is located in the most densely populated area among all nuclear plants in the country.

The Atomic Safety and Licensing Board on Oct. 15 began a series of hearings on Entergy Nuclear’s application to renew the licenses of two reactors at Indian Point in Buchanan, N.Y., for 20 years. The existing permits expire in 2013 and 2015. The federal Nuclear Regulatory Commission will make its recommendation on the relicensing after the board, a judiciary arm of the NRC, issues its non-binding conclusion.

Grassroots and environmental groups are stepping up their calls for shutting down the plant. New York Gov. Andrew Cuomo says the plant should be closed because of its risk to public safety.

The hearings in Tarrytown, N.Y., are focusing on ten “contentions,” or points of disagreement, regarding environmental issues and physical plant safety.

The issues raised by New York State and the environmentalist groups Riverkeeper and the Hudson River Sloop Clearwater include the effect of renewal on property values; the cost of human exposure to radioactivity; the impact of spent fuel pool leaks; the NRC analysis of alternative energy services; corrosion of pipes; the lifetime of inaccessible cable and electrical transformers; and legal and regulatory questions about the licensing renewal.

The approval could run into trouble because the state has denied Indian Point’s water quality permit. The plant kills billions of fish and eggs by drawing water from the Hudson River into the facility for cooling. Entergy Nuclear is appealing the denial, which it says would force it to spend $1.5 billion to build new cooling towers. The NRC has said it won’t renew the licenses without the permit.

Indian Point supplies about a quarter of the energy of New York City and adjoining affluent Westchester County, where the plant is located. Opponents of Indian Point say new energy sources could easily match the plant’s 2,000-megawatt capacity. A report released by Riverkeeper shortly before the opening of the licensing hearings puts the cost at $12 to $15 a year for residential consumers.

Robert Kennedy Jr., chief prosecuting attorney for Riverkeeper, said, “We have better, safer options. New York should lead with bold new policies to ensure that energy efficiency, wind and solar power play the key role in replacing Indian Point’s power.”

Over the years, grassroots and political pressure to close the plant has been somewhat sporadic. A dedicated group of core activists has persisted, but a long-term mass mobilization has never developed. But public concern re-awoke when one of the hijacked planes used in the 9/11 attacks flew over the plant, and more recently, when the nuclear disaster occurred in Fukushima, Japan.

Hopefully, the licensing controversy will add new evidence to the case for closing Indian Point.

The NRC says Indian Point could withstand up to a 6.1 magnitude earthquake, but a Columbia University study calls a 7.1 earthquake “quite possible.” Two earthquake fault lines pass nearby the plant.

The plant’s overfilled storage pools for spent fuel are leaking radioactive water into the ground and the Hudson River. A New York State evaluation described the plant’s evacuation plan as inadequate.

“I think this really spells the end of Indian Point,” said Kennedy about the licensing hearings. “The noose is tightening.”

Describing the plant, Marilyn Elie, a member of the Indian Point Safe Energy Coalition, who was with a dozen protestors on the opening day of the hearings, said, “It is old, dangerous and unnecessary.”

By GREGORY N. HEIRES

As Republican presidential candidate Mitt Romney continues to try to sell his conservative plan to cut taxes to voters, a recent Congressional Research Service study debunks the theory that reducing top tax rates spurs economic growth.

The Sept. 14 report, prepared for the U.S. Congress and certain to be dismissed or ignored by Republicans, also concludes that since 1945, government policies of cutting taxes of the wealthy have aggravated income inequality.

With both conclusions, the report thus shatters the conservative argument that tax cuts benefit society at large because the upward distribution of income and wealth they cause is mitigated by rising productivity.

While failing to be specific, Romney says he will extend the Bush cuts and provide even more tax breaks for the wealthy. The CRS report suggests that the plan would do little, if anything, to help the economy while worsening inequality, now about as bad as during the Great Depression.

President Barack Obama would increase the taxes on individuals with incomes above $200,000 and families earning $250,000.

As the report notes, the top marginal rate throughout the late-1940s and 1960s was 90 percent. Today, the rate is 35 percent. (The marginal rate expresses how much you are taxed for each additional dollar you earn.)

The top capital gains tax rate was 25 percent in the 1950s and 1960s, 35 percent in the 1970s and 15 percent today.

Did these tax cuts result in significant economic growth? No!

Real GNP growth averaged 2.4 percent in the 1950s. By 2000, that rate dropped to 1.7 percent.

What’s worse, while the economy and productivity grew together in the two decades after World War II, they diverged in the early 1970s until today, which meant workers stopped sharing the fruits of the expanding economy (however tepid its growth).

“Analysis of such data suggest the reduction in the top tax rates have had little association with savings, investment, or productivity growth,” the report, “Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945,” says.

But while the reduction in tax rates aren’t correlated with economic growth, the cuts appear to be associated with increasing inequality, according to the report.

The share of income going to the top 0.1 percent of families rose from 4.2 percent in 1945 to 12.3 percent in 2007. It fell to 9.2 percent in the 2007-09 recession, but is on the rise again.

Since 1945, tax cuts have been accompanied by a steady shift of wealth and income to the rich.

Romney likely views this report as a reflection of the “politics of envy,” a resentment on the part of those of us who lack the entrepreneurial spirit of successful business owners and managers.

But the report in reality is an indictment of years of public policies that have fueled a huge shift of our income and wealth to the economic elite.

Will ordinary Americans wake up and try to change the direction of this shifting tide? Or will the country continue to its degeneration into Third World status?

Obama: Progress on the Economy

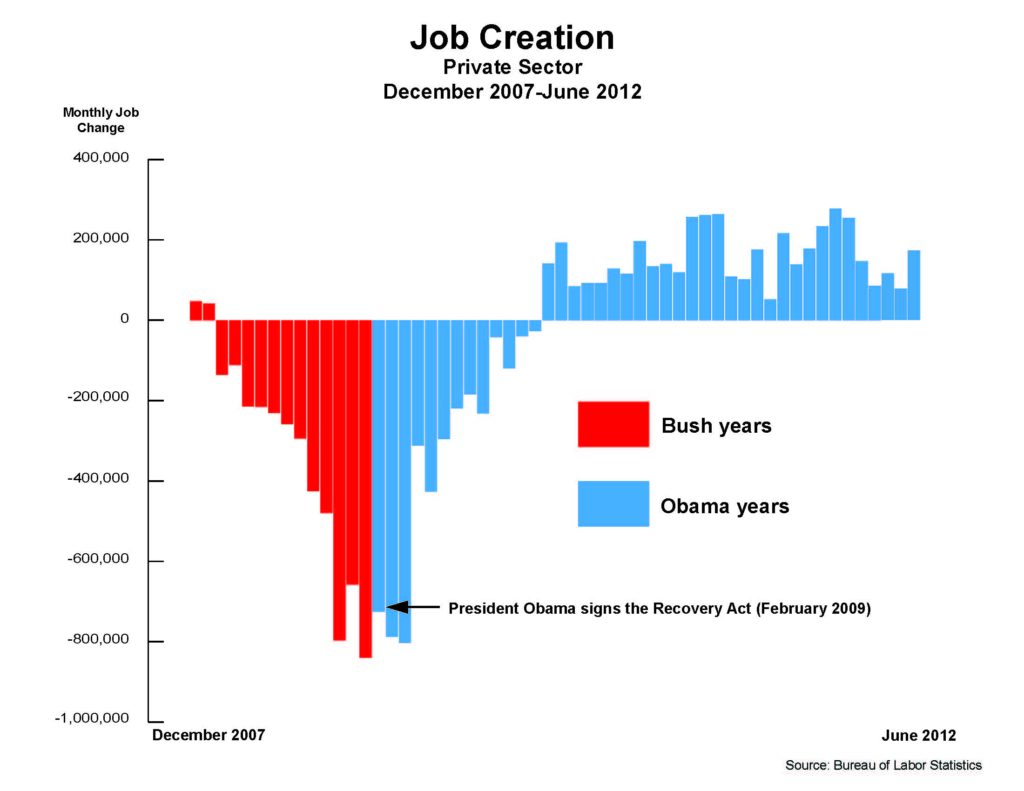

Nearly four years ago, President George W. Bush left behind the worst economic wreckage since the Great Depression of the 1930s. The country was bleeding 700,000 jobs a month when President Barack Obama took the oath of office in January 2009.

Economic gloom, insecurity and stark fear gripped the United States, as policymakers and ordinary Americans saw the specter of Great Depression 2.

Today, with a stubborn unemployment rate of 8.3 percent, the recovery is the slowest since World War 2, but the Great Recession is officially over. The economy, though still lackluster, appears on the mend with 163,000 jobs created in July, consumer confidence growing and manufacturing picking up.

“Our economy still needs to make up for job losses in the Great Recession and create more jobs to keep up with the growth of the labor force,” said Lisa Lindsley, director of Capital Strategies at the American Federation of State, County and Municipal Employees. “But the economy and unemployment would be much worse if the administration hadn’t pursued the stimulus.”

Obama pledges to build upon the successes of his first term. If re-elected, he aims to address the country’s inequality by making the wealthy pay their fair share and strengthening the economy with a new stimulus and greater support to the public sector.

Obama’s $787 billion stimulus put a stop to the job hemorrhaging and economic contraction. A larger stimulus would have meant a stronger recovery, but deficit hysteria and Republican obstructionism tied Obama’s hands. Overall, the independent Congressional Budget Office estimates that the stimulus created 3.3 million jobs.

“The stimulus was a success,” Rebecca Thiess, a policy analyst at the Economic Policy Institute in Washington said. “There is no question it led to economic growth, and unemployment would probably be 1½ to 2 percent higher without it.”

For the public sector, the stimulus provided billions of dollars that helped state and local governments make up for falling revenue and employees.

The severe downsizing in the public sector — 600,000 jobs lost since June 2009 — didn’t occur until the stimulus money was used up and Republicans in Congress sabotaged Obama’s plan for a second stimulus.

Obama’s American Jobs Act would devote $450 billion to help the unemployed get back to work, assist small businesses, prevent 280,000 school layoffs, invest in infrastructure and transportation, and modernize more than 35,000 schools.

But while Obama is running on a platform of activist government, the policies of Republican candidate Mitt Romney and his running mate, Congress member Paul Ryan, would put the country on a path to economic shrinkage and mass layoffs.

Ryan’s 2012 budget plan — embraced by Romney and touted by Republicans as the blueprint for their vision of government — calls for privatizing Medicare, handing the wealthy huge tax breaks, and slashing Medicaid, food stamps, Pell college grants and low-income housing. “I’m very supportive of the Ryan budget plan,” Romney said recently at a campaign event in Chicago.

The Economic Policy Institute estimates that the Ryan budget “would lead to a large and immediate job loss,” Thiess said, killing 1.3 million jobs in 2013 and 2.8 million in 2014.

The 2012 presidential election is turning out to be a grand debate about the role of government. The contrast between the philosophies of the candidates is clear in how they view the 2009 auto industry bailout.

On the campaign trail, Obama points out that General Motors is again the world’s largest automaker and enjoys record profits. Thanks to the bailout, auto firms and their suppliers have created 200,000 new jobs (though their unions now have two-tiered pay scales).

Catering to the anti-government Tea Party wing of the Republican Party, Romney demonstrated his “free-market” mentality earlier this year when he called the auto rescue “crony capitalism on a grand scale.” It seems Romney, former CEO of the job-killing Bain Capital private-equity firm, would have been content to allow the auto industry to die.

“President Obama and Vice President Biden are fighting for everyone to have a fair shot at the American Dream,” AFSCME President Lee Saunders said, after Romney announced his choice for vice president in August. Mitt Romney and Paul Ryan are plotting a nightmare for middle-class families.”

This is a revised version of an article that originally appeared in the September 2012 edition of Public Employee Press, the official publication of DC 37, AFSCME (AFL-CIO), representing 120,000 public employees in the City of New York.

By GREGORY N. HEIRES

Republican presidential candidate Mitt Romney likes to tout his experience in the private sector when he tells voters he would create millions of jobs and turn around the economy if elected.

But a look at the dark side of his track record as head of Bain Capital — the private equity firm he started with the help of funders linked to death squads in El Salvador — suggests that this is a lie.

Yes, Bain Capital has turned around troubled companies. But earlier this year, the Romney campaign was forced to back away from its candidate’s claim to have created 100,000 jobs at Bain. And the closer Election Day comes, the faster Romney runs from the firm’s ugly history of mass layoffs, outsourcing, bankruptcies and ruined lives.

Romney tried to distance himself from Bain’s pattern of economic destruction by saying he left the company in 1999 to run the Olympics in Salt Lake City. Yet Bain’s official filings with the U.S. Securities and Exchange Commission list him as CEO through 2002, so he bears responsibility for their destructive policies.

And Romney continues to profit personally from Bain Capital, thanks to a severance deal that provides him with millions of dollars every year. The fortune he amassed at Bain gives him the personal economic freedom to make a run to look after the interests of the 1 percent (including himself) in the White House.

Romney puts forth the bogus claim that he is a job creator while criticizing the jobs record of his Democratic opponent, President Barack Obama. True, unemployment remains stubbornly stuck at 8 percent. But the independent Congressional Budget Office concluded that Obama’s economic stimulus created at least 3.3 million jobs, while Romney’s Republicans in the U.S. Congress set up roadblocks to prevent Obama from further significant action.

With Romney directly in charge, Bain Capital earned $2.5 billion for its investors in 77 deals, according to the Wall Street Journal. Twenty-two percent of those cases resulted in bankruptcy filings or plant closings, some of them with huge job losses.

A New York Times analysis of 40 Bain-controlled U.S.-based companies from 1984 to 1999 found that at least seven wound up in bankruptcy. Bain investors earned $400 million in four of the bankruptcies.

Bain’s job-killing business practices led to the loss of 1,700 jobs at Dade International, a medical supply company; 3,500 at KB Toys and 750 at GS Industries, according to the ThinkProgress website.

But one wonders whether the human misery caused by Bain Capital concerns its founding investors, who were handpicked by Romney.

By one estimate, El Salvadoran families with ties to death squads provided $6.5 million of the $37 million that allowed Romney to establish Bain Capital.

“I came to Miami to find partners that would believe in me and finance my enterprise,” Romney said at a dinner party in the 1970s.

Among the investors he mentioned that evening was Ricardo Poma, whose family backed the right-wing ARENA party headed by death squad leader Roberto D’Aubuisson, who ordered the assassination of Archbishop Oscar Romero. Romero was gunned down as he celebrated Mass the day after he urged government soldiers to put down their arms. D’Aubuisson’s death squad also raped and murdered three Maryknoll nuns and a churchwoman.

Perhaps the story of Bain is that naked capitalism and morals simply don’t mix. Do we really want a president who prefers profits over people — someone who actually says corporations are equivalent to people?

Said Marc B. Walpow, a former managing partner at Bain who worked closely with Romney, “I never thought of what I do for a living as job creation. The primary goal of private equity is to create wealth for your investors.”

This article is reprinted from the September 2012 edition of Public Employee Press, the official publication of DC 37, AFSCME (AFL-CIO), representing 120,000 public employees in the City of New York.