Plutocracy U.S.A.

Plutocracy U.S.A.

By GREGORY N. HEIRES

Let’s be honest: The United States has become a plutocracy.

Reports about inequality typically focus on the country’s growing income gap, now the most skewed since the Great Depression.

But the country’s class and racial divide appears to be even more staggering when you examine the distribution of wealth.

Consider the following:

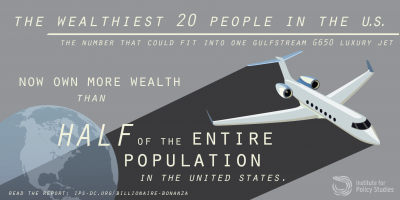

• The 20 wealthiest people in the United States own more than the combined wealth of the bottom half of the U.S. population, which is made up of 152 million people in 57 million households.

• The Forbes 400—the wealthiest group in the United States—own as much wealth as the entire African-American population and one third of the Latino population combined.

• The typical American family has a net worth of $81,000. The Forbes 400 own more wealth than the 36 million families who fit that financial portrait.

These are the findings of a recent report, “Billionaire Bonanza: The Forbes 400 . . . and the Rest of Us,” by the Institute for Policy Studies. The report is based on data from the recently released 2015 Forbes 400 magazine and the Federal Reserve’s latest triennial Survey of Consumer Finances.

The report acknowledges that many members of the Forbes 400 accumulated their wealth through successful corporations and innovation. Yet they have also benefitted from public policies—tax breaks, trade rules, regulations—that work in their favor at the expense of ordinary Americans. The accumulation of wealth is accompanied by an accumulation of political power.

The Wealth Space Needle

The concentration of wealth is at its most extreme since Forbes began its top 400 ranking in 1982.

The wealthiest 400 individuals in the country have amassed a total wealth of $2.34 trillion. That is more than the GDP of India, which has a population of 1 billion people. The small group could fit comfortably into a luxury Gulfstream G650 private jet.

The distribution of wealth is usually pictured as a pyramid. The IPS report says the country’s extreme distribution of wealth is better depicted by the Space Needle in Seattle.

The bulge atop the Space Needle represents the wealthiest 0.1 percent of the U.S. population. The Forbes 400 could fit in the luxury restaurant at the top of the Space Needle.

The elite 0.1 percent group, made up of 115,000 households, holds 20 percent of the country’s total wealth, about triple of what it held in 1972 (7 percent). With a net worth starting at $20 million, the group owns more than 20 percent of the country’s wealth. In fact, the top 0.1 percent owns more than the bottom 90 percent of the population.

The Racial Gap

The wealth accumulation of African-Americans and Latinos is significantly less than that of whites:

• The homeownership rate of white Americans in 2015 is 71.9 percent. The rate of African Americans is 42.4 percent and for Latinos it is 46.1 percent.

• About 55 percent of whites own some stock. But only 28 percent of African-Americans and 17 percent of Latinos own stocks.

The wealthiest 100 members of the Forbes 400 own as much wealth as the entire African American population of 42 million people, according to the report. The wealthiest 186 members of the Forbes 400 own as much wealth as the entire Latino population of 55 million people. The Forbes 400 has only two African-American and five Latino members.

“The United States has a persistent racial wealth divide, the result of a multi-generational legacy of discrimination in asset building that began during slavery and has continued right up to the present-day discrimination in mortgage lending,” the report says.

The Social Cost of Inequality

Why should we care about inequality?

• The wealth divide undermines the trust in our political and civic institutions. In the first phase of the 2016 presidential cycle, 158 wealthy donors accounted for half of all campaign contributions.

• The poor suffer disproportionately from health afflictions, and their mortality rate is higher than more wealthy people.

• Extreme inequality leads to less upward mobility. It creates disenchantment with the political system. And it fuels economic instability.

Over decades, the wealthy have rigged our political system and economic rules to serve their interests. Policy steps that would help reverse the rise in wealth concentration include: instituting progressive wealth and estate taxes; improving the safety net; raising the minimum wage; enacting campaign reform to allow for publicly financed elections; preventing corporations from depositing profits abroad to avoid taxes and taxing capital gains at the higher rate of ordinary income.

Restructuring student loans and creating a tuition-free public college system would allow students to start their careers with manageable loan payments or debt-free.

Creating “baby bonds” –investment accounts for newborns—would allow individuals to steadily accumulate savings from the day they are born. Affordable housing would help people with modest incomes purchase homes and accumulate wealth.

Unless we act, inequality will only continue to grow, the IPS report concludes, and we will continue to live in a plutocracy of gated communities, a shrinking middle class, a political system controlled by the rich, and an unconscionable racial divide.

Who are members of the Forbes 400?

The top 20 Forbes 400 includes:

Bill Gates ($71 billion, Microsoft)

Warren Buffett ($62 billion, Berkshire Hathaway)

Larry Ellison, $47.5 billion, Oracle)

Jeff Bezos ($47 billion, Amazon)

Charles Koch ($41 billion, Koch Industries)

David Koch ($41 billion, Koch Industries)

Mark Zuckerberg ($40.3 billion, Facebook), Michael Bloomberg ($38.6 billion, Bloomberg LP)

Jim Walton ($33.7 billion, Wal-Mart heir),

Larry Page ($33.3 billion, Google)

Sergey Brin (32.6 billion, Google)

Alice Walton ($32 billion, Wal-Mart heir)

S. Robson Walton ($31.7 billion, Wal-Mart heir)

Christy Walton ($30.2 billion, Wal-Mart heir)

Sheldon Adelson ($26 billion, Sands Casino)

George Soros ($24.5 billion, hedge funds)

Phil Knight ($24.4 billion, Nike)

Forrest Mars Jr. ($23.4 billion, Mars Candy heir)

Jacqueline Mars ($23.4 billion, Mars Candy heir)

John Mars ($23.4 billion, Mars Candy heir).